You need homeowner’s insurance to protect your home, which is likely your biggest investment. Even though you don’t want to, having the right coverage is like having a safety net in case something goes wrong. It helps you in this way.

- Covers Repairs and Rebuilding Costs: Repairs and rebuilding costs are covered by your policy. If your home is damaged by fire, storms, or other events that are covered, your policy will help pay for repairs or even a full rebuild.

- Protects Your Belongings: A lot of policies can also cover your own things, like furniture, electronics, and clothes, if they get lost or stolen.

- Covers Liability: If someone gets hurt on your property, homeowner’s insurance can help pay for their medical bills or legal fees.

For the most part, it makes you feel calm. You worry less when you know you have protection against things that might go wrong. Having that peace of mind is very important when making such a big purchase.

Your first insurance payment will be part of your closing costs, but you’ll still need to plan for it in your budget after the fact. That’s because it’s a cost you’ll have to pay every month after you move in.

Here is what you need to know to help you plan your budget for this important part of owning a home right now.

Costs and Claims Are Rising

The cost of insurance has been going up over the past few years. Insurance.com says that the big reason for the rise in rates is fourfold:

- Claims are going up because of more severe weather and wildfires.

- Some states are making it harder for homeowners to get insurance because insurance companies are leaving high-risk areas.

- Rate hikes in the past haven’t kept up with the rise in claims.

- It now costs more to rebuild or fix up homes because the cost of materials and labor has gone up.

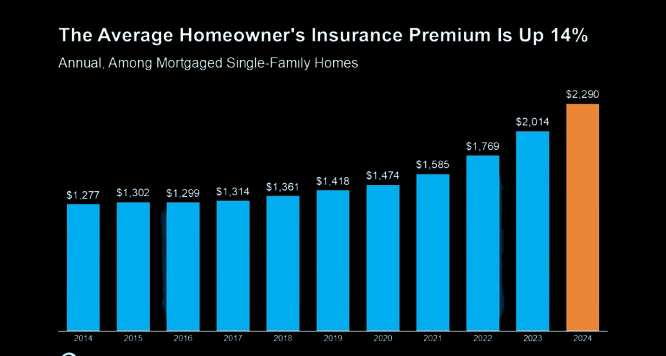

In short, disasters are happening more often, fixing them costs more, and insurance companies have to change their rates to keep up. The following graph from ICE Mortgage Technology shows how the average yearly premium has gone up over the last ten years:

What You Can Do About It

You need homeowner’s insurance to protect your home and your money. But because prices are going up, you’ll need to do your research to find the best coverage at the best price.

How much homeowner’s insurance costs depends on where you live, who you get it from, and what you cover. Compare prices and shop around before you choose a policy. Don’t forget to ask if there are any deals. A security system or bundling your home and auto insurance could help you save money on your insurance.

Bottom Line

If you want to buy a house, you should think about more than just your mortgage payment. You should also set aside money for your home insurance. This protects you from many bad things that could happen. Costs are going up, but there are things you can do to try to get the best deal.

FAQs

What does homeowner’s insurance cover?

A homeowner’s insurance policy protects a person financially against losses and damages to their home, including furniture and other things they keep there. It usually covers damage to the inside and outside of the building, loss or damage to personal belongings, and injuries that happen on the property.

Why is it important to have home insurance?

Getting homeowners insurance is important because it protects one of your biggest investments, your home. It gives you peace of mind by covering unplanned events like accidents, theft, or natural disasters, so you don’t have to pay a lot of money out of your own pocket.

What does a normal home insurance policy cover?

Usually, a standard policy covers the following:

- Dwelling: Fixes or rebuilds your house if it gets damaged by specified risks.

- Personal Property: This covers things like clothes and furniture that are lost or stolen and needs to be replaced.

- Liability Protection: This protects you from having to pay for legal fees if someone gets hurt on your property.

- If your home is damaged by a covered event and you need to stay somewhere else temporarily, Additional Living Expenses (ALE) will pay for it.

Is there anything that my home insurance doesn’t cover?

There are times when standard policies don’t cover things like floods, earthquakes, and normal wear and tear. It is very important to go over your policy again and think about getting extra coverage or separate policies for these risks.

How can I get my home insurance rates to go down?

To get your rates lowered, you can:

- Raise your deductible.

- Combine your home insurance with other types of insurance, like car insurance.

- Add safety features like smoke alarms, burglar alarms, and storm shutters.

- Keep your credit score high.

- Check and update your policy often to make sure you don’t have too much insurance.