In today’s market, first-time homebuyers may feel that the odds are stacked against them. However, if you know where to look, there are programs and resources available that can be helpful. And what can facilitate the process of becoming a homeowner? a home loan from FHA.

The reason so many first-time homebuyers are using them is because they are made to assist you in overcoming some of the most significant financial obstacles in the process.

An FHA home loan might be the way to achieving your goals of eschewing rent, establishing roots, or simply having a home that is truly yours sooner rather than later.

Buying Your First Home Probably Doesn’t Feel Easy Right Now

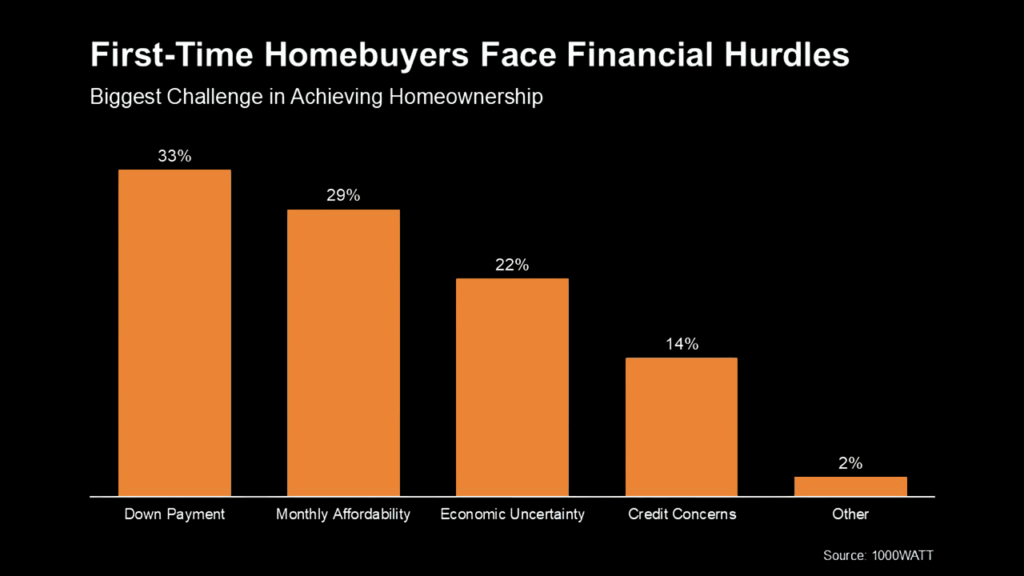

Even though many people still have the desire to purchase a home, affordability is a major obstacle in the modern world. Potential first-time buyers say that saving enough for a down payment and making monthly mortgage payments work given current home prices and mortgage rates are their top two concerns, per a 1000WATT survey (see graph below):

That’s Where FHA Loans Come In

Many first-time buyers are able to overcome these obstacles with the aid of FHA loans.

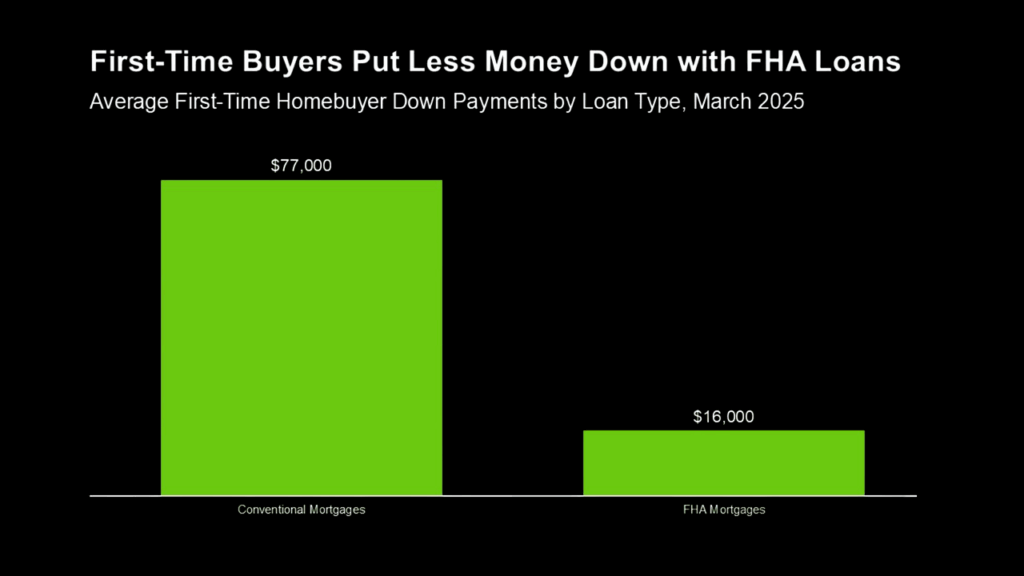

The average first-time buyer who takes out an FHA loan actually only makes a $16,000 down payment, according to Intercontinental Exchange (ICE). Compared to the $77,000 they would typically put down for a conventional mortgage (see graph below), that represents a significant difference:

In essence, buyers who take out an FHA loan might not need to provide as much cash up front. However, the benefits don’t end there. Additionally, you might be able to make a smaller monthly payment.

This is due to the fact that FHA loans frequently have lower mortgage rates. According to Bankrate:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

Therefore, it might be worthwhile to look into an FHA loan if you’re considering purchasing your first home.

It might help with the two most common challenges that first-time buyers currently face: saving enough money up front and being able to afford the monthly payment. This is because it may result in lower down payment requirements and possibly even a lower mortgage rate.

A reputable lender can help you understand the specifics, weigh your options, and determine which kind of loan is best for you.

Bottom Line

It might be easier than you think to become a homeowner with the correct loan and advice.