A recession is more likely to happen this year than last. The economy is talked about a lot in the news. That makes a lot of people wonder what it means for their home’s value and their ability to buy something else.

Going all the way back to the 1980s, let’s look at some old data that shows what happened in the housing market during each recession. You might be surprised by the facts.

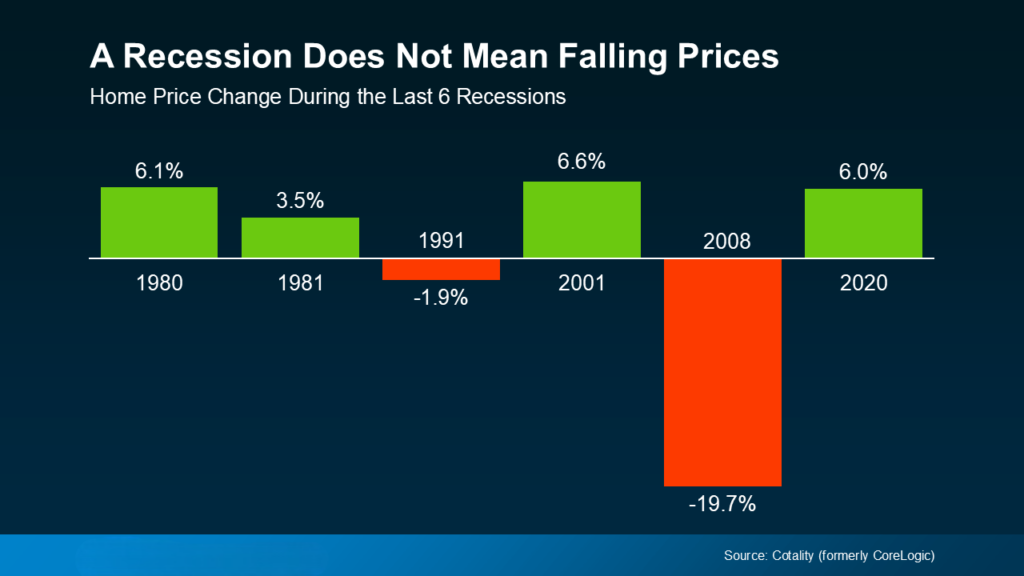

A Recession Doesn’t Mean Home Prices Will Fall

A lot of people believe that home prices will drop like they did in 2008 if there is a recession. That wasn’t the norm, though; it was just one time. Prices dropped so sharply on the market only that one time. It hasn’t happened since, mostly because there are still not many items in stock. Since the housing crash, there are still not nearly as many homes for sale as there were before. This is true even in markets where the number of homes for sale has started to rise this year.

This is not true. According to information from Cotality (formerly CoreLogic), home prices went up in four of the last six recessions (see graph below).

So, don’t think that home values will drop a lot during a recession. That idea is not supported by the data. Instead, home prices tend to stay on the path they’re already on. Also, home prices are still going up across the country, though at a more normal rate.

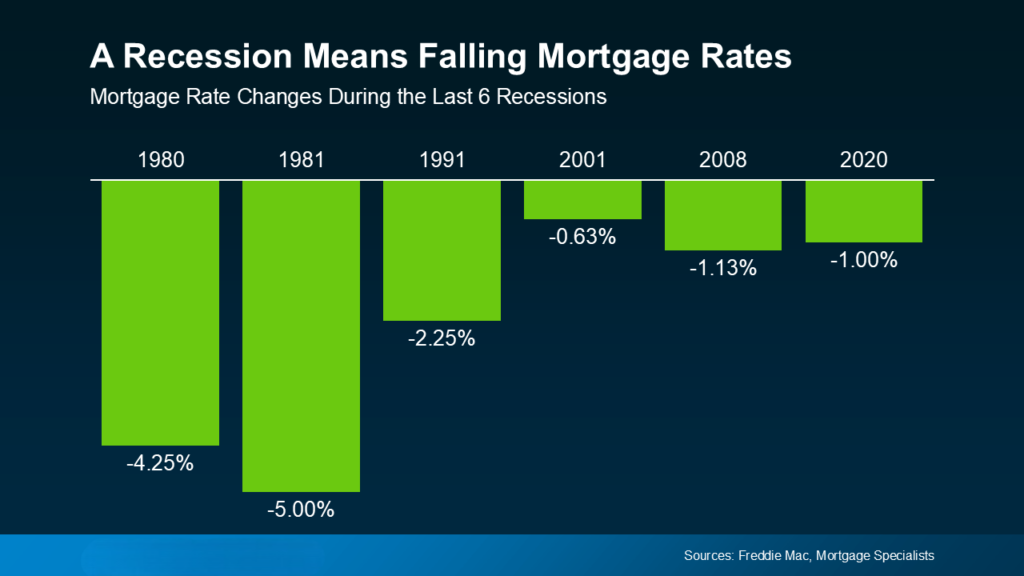

Mortgage Rates Typically Decline During Recessions

When the economy slows down, mortgage rates tend to go down, but home prices tend to stay the same. Once more, mortgage rates have gone down every time there has been a recession in the last six years (see graph below):

Rates could go down during a recession. That would help you buy things, but don’t count on a 3% rate to give you a return.

Bottom Line

The question of the recession still has no answer, but the chances have gotten better. That doesn’t mean you need to worry about what it means for the housing market or your home’s value, though. Data from the past tells us what usually takes place.