What about how much your home is worth? It’s something you might not check as often as your bank account. It is important to remember this when it comes to your money, though. When did you last get someone to tell you how much your house is worth?

Take a look. For most people, their home is their most valuable asset. And if you’ve had your home for a few years or longer, it’s likely been quietly making you money in the background. And to be honest? You might be shocked at how much.

What Is Home Equity?

This wealth that you might not even know you have comes from the value of your home. What you still owe on your mortgage and how much your home is worth are two different things. If you pay down your mortgage every month and the value of your home goes up over time, it grows. To really help you understand how this works, here’s an example.

Your house is now worth $500,000, and you still owe $200,000 on your loan. That means you have $300,000 saved up. This is also a good time for most homeowners to build equity.

Cotality, which used to be called CoreLogic, says that the average homeowner with a mortgage has $311,000 in equity.

Why You Probably Have More Than You Think

If you own a home, you have record amounts of equity right now for two main reasons:

1. Significant Home Price Growth.

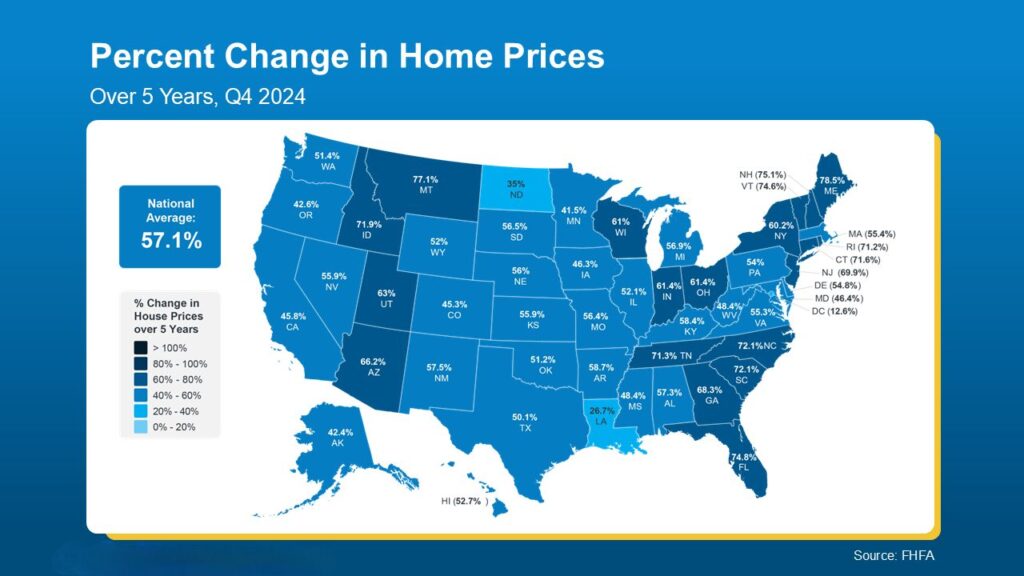

The Federal Housing Finance Agency (FHFA) says that over the last five years, home prices have gone up by more than 57% across the country (see map below):

And if you bought your home more than a few years ago, it’s probably worth a lot more now than it did when you bought it. This is because prices have been going up a lot lately.

2. People Are Living in Their Homes Longer.

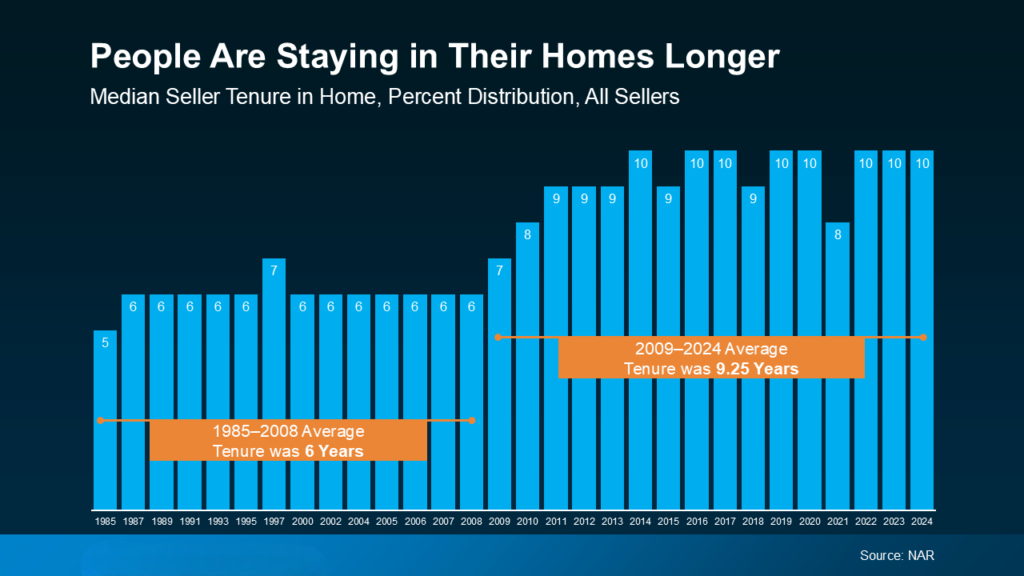

Statistics from the National Association of Realtors (NAR) show that most people stay in their home for about 10 years (see graph below):

It’s longer now than it was before. And during that ten years? You’ve built equity just by paying your mortgage and riding the wave of your home’s value going up.

If you’re one of those people who has lived in their home for that long, here’s how much the price growth behind the scenes has helped you. From what NAR says:

“The average homeowner has gained $201,600 in wealth over the past ten years just from home prices going up.”

What Could You Actually Do with That Equity?

Keep in mind that your home may be your most valuable asset. If you’re smart about how you use your equity, it could give you some great future opportunities.

- It can help you buy a new home. The money you have saved up could help you pay for the down payment on your next home. Sometimes, it could even mean that you can pay cash for your next home.

- Fix up your current home so it fits your needs better now. And if you plan your projects well, they might even make your home worth more when you decide to sell it.

- Come up with the business idea you’ve always had. Your equity could be just what you need to pay for marketing, equipment, or starting up costs. In turn, that could help you make more money, giving you yet another financial boost.

Bottom Line

It’s likely that your home is worth a lot more than you think. Your equity is more than just a number. You should know what your options are if you want to sell, upgrade, or just learn more about them. It’s a tool.