Since it seems like the price of almost everything is going up, it makes sense to wonder what that means for the housing market. Some people are even wondering if more homeowners will have trouble making their mortgage payments, which could cause a lot of homes to be foreclosed on. And new information showing that more foreclosure filings have happened only adds to this fear. Don’t be scared by that, though.

Once you understand the new information, it’s clear that this is not a repeat of the last housing crash.

This Isn’t Like 2008

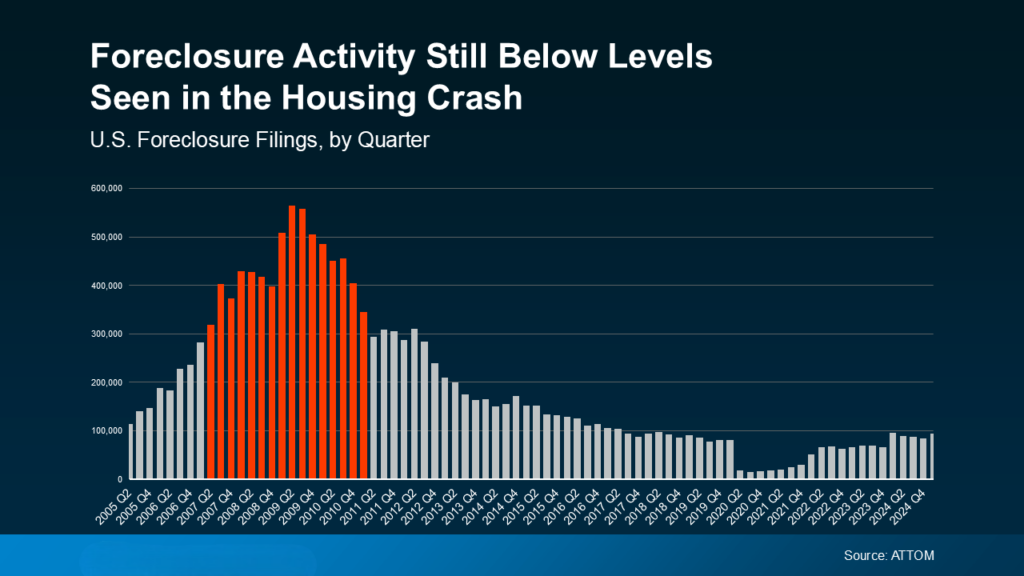

In ATTOM’s most recent quarterly report, the number of foreclosure filings did go up a bit, but they’re still lower than usual and much lower than levels seen during the crash. See that much better if you make a graph of it.

The market is in a very different state now than it was in the years leading up to the 2008 crash (shown in red on the left side of the graph). See the graph below for more information:

People got mortgages they couldn’t pay back back then because lenders were taking risks. It caused a lot of homes to go into foreclosure, which flooded the market with bad homes. There were too many homes for sale, so prices dropped sharply.

The rules for loans are much stricter now, and most homeowners are in much better financial shape. That’s why there are so few filings this time.

And just in case you think things have gotten worse since 2020 and 2021, here’s what you need to know. During those years, there was a moratorium on foreclosures that was meant to help millions of homeowners get through hard times without losing their homes. That’s why the numbers from a few years ago were so very low.

Don’t compare now to when things were bad. If you look at more normal years, like 2017–2019, the number of foreclosure filings is actually lower than usual, and it was much lower during the crash.

Of course, nobody wants to go through the foreclosure process. And the recent rise is emotional because real people’s lives are being affected. Let’s not forget that. Just that this isn’t a sign of trouble in the market as a whole.

Why We Haven’t Seen a Big Surge in Foreclosures

Another thing to reassure you is that you have equity in your home. Home prices have gone up a lot in the last few years. That means that homeowners today have a good amount of money saved up. Rob Barber, CEO of ATTOM, says it this way:

“Levels are still below historical norms, but the growth over the last three months suggests that some homeowners may be beginning to feel the effects of the ongoing economic problems.” Strong home equity positions in many markets, on the other hand, continue to protect against a bigger jump.

In short, if someone gets really poor and can’t pay their mortgage, they might be able to sell their house instead of letting it go into foreclosure. That’s very different from 2008, when many people owed more on their homes than they were worth and had to leave.

Don’t forget how much equity most homeowners have right now. Rick Sharga, founder and CEO of the CJ Patrick Company, says in a new Forbes article:

“…a big reason for today’s relatively low levels of foreclosure activity is that homeowners, even those who are in foreclosure, have more equity in their homes than ever before.”

Bottom Line

Even though the number of foreclosures has been going up lately, it is still not as high as it was during the 2008 crash. Also, even though prices are going up, most homeowners today have a lot more equity in their homes.